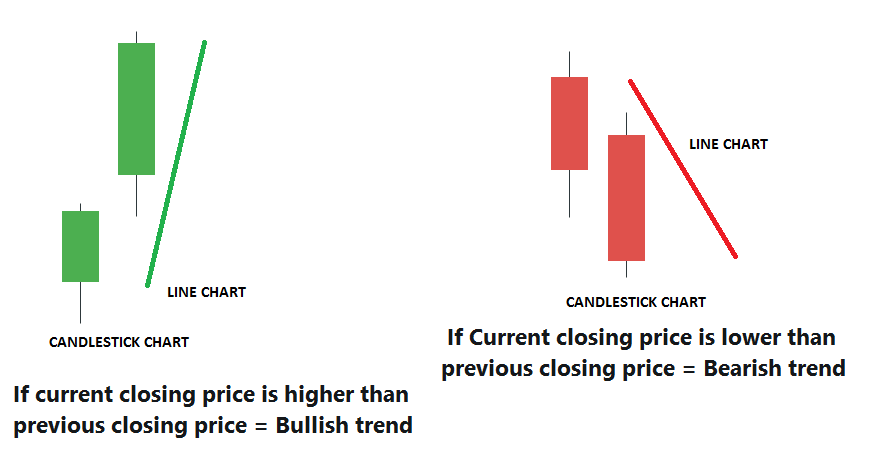

Definition: RSI diversence is a technical analysis tool which compares the direction an asset's price moves in relation to the index of relative strength (RSI).

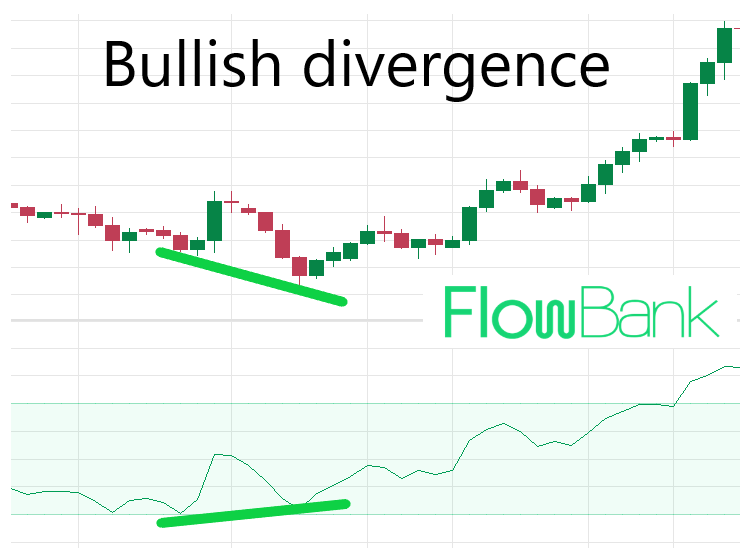

Signal Positive RSI divergence indicates a bullish signal. Negative RSI divergence signals an alarm for bears.

Trend Reversal: RSI divergence could signal a potential trend reverse.

Confirmation RSI diversification can be utilized together with other analysis techniques as a confirmation.

Time-frame: RSI divergence may be examined at different times to gain different insights.

Overbought or Oversold: RSI values above 70 indicate conditions of overbought and values lower than 30 indicate that the market is oversold.

Interpretation: To understand RSI divergence in a correct manner, you need to consider other technical and fundamental factors. Take a look at top trading platforms for more info including backtesting platform, crypto trading backtester, backtesting platform, crypto trading backtesting, crypto trading bot, best crypto trading platform, forex trading, forex trading, automated forex trading, online trading platform and more.

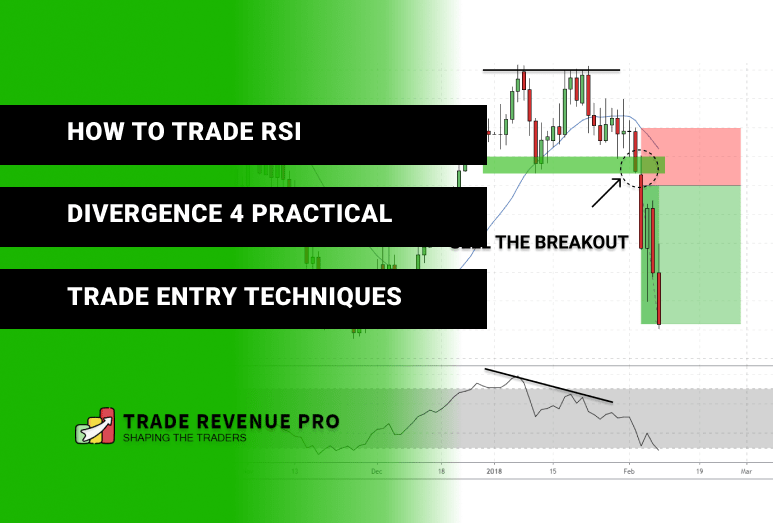

What Is The Difference Of Regular Divergence And Concealed Divergence

Regular Divergence occurs the case when an asset's price is an upper or lower low while its RSI makes a lower or higher low. It may indicate a trend reversal. But it is important to consider fundamental and technical factors. This is less significant than normal divergence, however it could signify a trend reversal.

Be aware of the technical aspects:

Trend lines and support/resistance levels

Volume levels

Moving averages

Other indicators and oscillators of the technical world.

Consider the following important factors:

Economic data released

Details specific to your company

Market sentiment and other sentiment indicators

Global events and the impact of markets

Before making investment decisions based upon RSI divergence indicators, it is important to consider both the technical and fundamental aspects. Follow the most popular bot for crypto trading for blog examples including trading platform crypto, forex tester, backtesting tool, automated forex trading, forex backtesting software, divergence trading forex, backtesting tool, crypto trading, best trading platform, RSI divergence and more.

What Are Strategies To Backtest Trades When Trading Crypto

Backtesting strategies for cryptocurrency trading involves replicating trading strategies using historical data to assess the potential for their profitability. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy: Create the trading strategy that will be tested.

Simulator: Software that allows you to create a simulation of trading strategies based on historical data. This lets you see how the strategy could have performed in the past.

Metrics: Use metrics to assess the effectiveness of your strategy like the profitability, Sharpe, drawdown, or any other measures that are relevant.

Optimization: Tweak the parameters of the strategy, then run the simulation in order to optimize the strategy's performance.

Validation: Check the performance of the strategy using outside-of-sample data to confirm its reliability and to avoid overfitting.

Keep in mind that the past performance of a company is not an indication of future results and results from backtesting should not be taken as a guarantee of future gains. Also, live trading requires to consider the impact of the volatility of markets transactions fees, market volatility, and other real world considerations. See the recommended best trading platform for site examples including trading platforms, automated crypto trading, backtesting trading strategies, divergence trading, crypto backtesting, best forex trading platform, automated trading, automated trading, software for automated trading, forex trading and more.

What Is The Most Efficient Way To Evaluate Your Backtest Software For Forex?

These are the primary considerations when evaluating backtesting software for forex that permits trading with RSI Divergence.

Flexibility: Software needs to be able to accommodate customization and testing of various RSI divergence trading strategies.

Metrics: The software should provide a range of metrics for evaluating the performance of RSI divergence trading strategies, including profitability, risk/reward ratios, drawdown, and other relevant measures.

Speed: Software must be quick and efficient, which will allow you to test quickly multiple strategies.

The user-friendliness. The software should be simple and user-friendly to comprehend, even for those with little technical analysis background.

Cost: Consider the price of the software. Also, consider whether the software falls within your budget.

Support: You need good customer support. This includes tutorials as well as technical assistance.

Integration: The program must be able to integrate with other trading tools like trading platforms and charting software.

It is recommended to test the software out by using a demo account before you commit to paying for a subscription. This will ensure that it is able to meet your requirements and is user-friendly. Follow the best divergence trading forex for more examples including automated crypto trading, automated cryptocurrency trading, trading divergences, best crypto trading platform, trading platforms, forex backtester, forex backtesting software, backtesting, trading platforms, crypto trading backtester and more.

How Do Robots For Trading In Cryptocurrency Work In Automated Trade Software?

A set of pre-determined rules are implemented by crypto trading robots that execute trades for the user. The following is the basic strategy: The user determines a trading plan that comprises entry and exit criteria, position sizing, risk management, and risk management.

Integration Through APIs, the trading bot can be connected to cryptocurrency exchanges. This allows it to access real time market data and execute trades.

Algorithm : The bot uses algorithms to analyze market trends and makes trading decisions based upon the defined strategy.

Execution Automated execution: The bot executes trades according to the rules outlined in the trading strategy without the need for manual intervention.

Monitoring: The bot watches the market on a regular basis and adjusts the trading strategy to reflect this.

Trading bots for cryptocurrency can be used to execute complex or repetitive trading strategies. This allows for less intervention from a manual standpoint and allows users to profit from market opportunities 24-7. Automated trading is not without risks. It could be susceptible to security and software bugs, weaknesses, or even lose control over trading decisions. Before utilizing any trading platform to trade live, it is essential to thoroughly test it.