What Should I Consider When Buying What Should I Consider When Purchasing A Hematologist Email List? When you purchase a hematologist's email list, it is essential to concentrate on a number of crucial aspects to ensure that the list you purchase is effective, accurate legal, compliant and pertinent to your goals in marketing. These are the most cr

30 Excellent Reasons For Picking Oxplay Sites

Tips To Oxplay Indonesian Online Betting Platforms On User Experience The user experience (UX) is an essential element of any online betting platform. It includes everything from website design to customer support and can have a direct effect on how enjoyable and effective your betting experience is. Here are the top 10 strategies for Oxplay Indone

30 Recommended Pieces Of Advice For Deciding On 7 Raja Togel Websites

The 10 Best Tips To Pay Alternatives For 7raja Togel Indonesian Online Betting Platforms Payout options must be considered when evaluating 7 Raja Togel Indonesian sites for betting online. Payment methods' availability as well as their convenience and security could have a major impact on the experience you have when betting. Here are the top 10 su

30 Best Suggestions For Choosing ASIAN 2 BET Websites

Top 10 Tips For ASIAN 2 BET Indonesian Online Gambling Platforms On Regulation And Licensing Understanding the ASIAN2BET Login Indonesian laws and licensing requirements is essential when looking at gambling websites. It will allow you to enjoy a safe and secure betting experience. Below are the top ten suggestions regarding ASIAN2BET Login Indones

30 Best Reasons For Picking TAJIR4D Sites

Top 10 Tips On Payment Options For tajir4d Indonesian Online Betting Platforms Payout options are essential when evaluating tajir4d togel Indonesian internet betting platforms. Payment options' accessibility in terms of convenience, security, and accessibility can have a significant impact on your betting experience. Here are the top 10 tips to eva

Rider Strong Then & Now!

Rider Strong Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Destiny’s Child Then & Now!

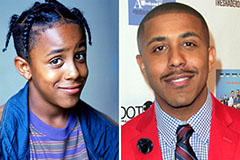

Destiny’s Child Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now!